how much of my paycheck goes to taxes in colorado

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents only. Are you ready to claim your Colorado Cash Back rebate.

State Income Tax Rates Highest Lowest 2021 Changes

Colorado Paycheck Quick Facts.

. Federal income tax and FICA tax. Employers are required to file returns and remit. This marginal tax rate means that.

For annual and hourly wages. Colorado tax year starts from July 01 the year before to June 30 the current year. It is not a substitute for the advice.

Colorado income tax rate. Calculate your tax year 2022 take home pay after federalstatelocal taxes deductions and exemptions. Colorado has a straightforward flat income tax rate of 455 as of 2021.

Supports hourly salary income and multiple pay frequencies. Colorado Hourly Paycheck Calculator. Your total tax would be.

The Colorado Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Colorado State. Your total tax for 2020 is 4538. Census Bureau Number of cities that have local income.

Coloradans will receive a tax rebate of 750 for individual filers and 1500 for joint filers beginning in August 2022. Colorado income tax rate. The income tax is a flat rate of 455.

These are the federal tax brackets for the taxes youll file in 2022 on the money you made in 2021. Census Bureau Number of cities that have local income taxes. The final 25000 of your income would be taxed at 30 or 7500.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Income amounts up to 9950 singles 19900 married couples filing. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding.

If you earn anywhere between 9951 and 40525 you will owe 995 plus 12 of the amount you make over 9950 the top of the previous bracket. The next 30000 would be taxed at 20 or 6000. No standard deductions and exemptions.

No state-level payroll tax. Residents who live in Aurora Denver Glendale Greenwood Village or Sheridan however - must also pay local taxes called an Occupational Privilege Tax. Your average tax rate is 1198 and your marginal tax rate is 22.

Your employees get to sit this one out so dont withhold FUTA from their paychecks. This free easy to use payroll calculator will calculate your take home pay. Colorado Paycheck Quick Facts.

As an employer youre paying 6 of the first 7000 of each employees taxable income. So the tax year 2021 will start from July 01 2020 to June 30 2021. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

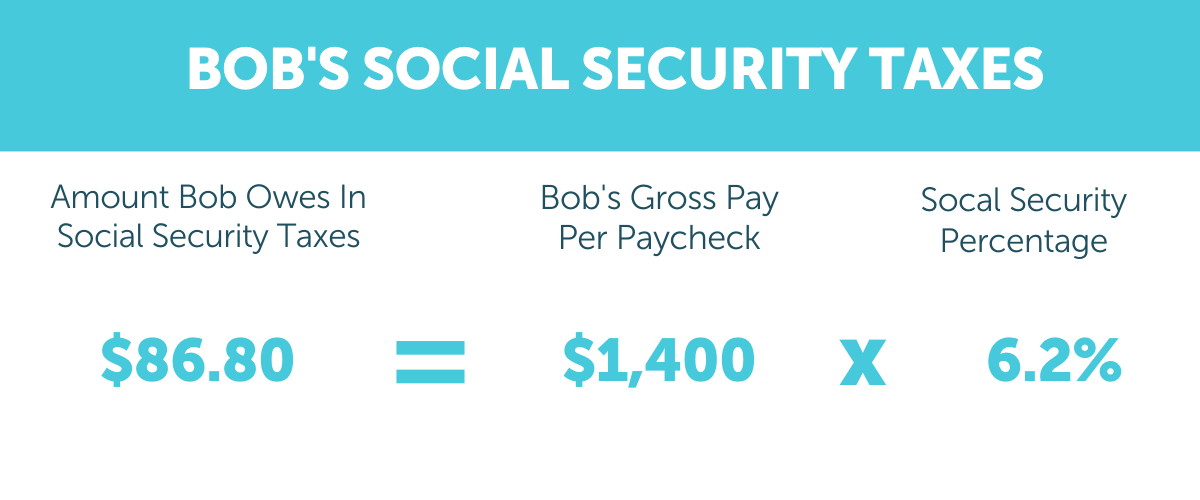

While your marginal tax rate was 12 your effective tax rate or the average rate of tax you paid on your total income was lower. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. You are able to use our Colorado State Tax Calculator to calculate your total tax costs in the tax year 202223.

Our calculator has recently been updated to include both the latest Federal Tax. Colorado Salary Paycheck Calculator. If your monthly paycheck is 6000 372 goes to.

If you make 70000 a year living in the region of Colorado USA you will be taxed 11001. 2000 6000 7500. How Your Paycheck Works.

22 for 40525 -.

Here S How Much Money You Take Home From A 75 000 Salary

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

2022 Federal State Payroll Tax Rates For Employers

Oh Tax Season Here Are 10 Must Know Tax Tips If You Work From Home To Help You Out This Tax Season Tax Irs Refund Selfemployed Tax Season Tax Help Tax

Understanding Your Pay Statement Office Of Human Resources

How Many Taxes Are Taken Out Of A 700 Paycheck Quora

How Do State And Local Individual Income Taxes Work Tax Policy Center

Paycheck Calculator Take Home Pay Calculator

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W4 Tax Form Tax

Here S How Much Money You Take Home From A 75 000 Salary

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Different Types Of Payroll Deductions Gusto

If You Re Self Employed You Re Still Eligible For The Paycheck Protection Program Here S How It Works Self Employment Paycheck Payroll Taxes

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Colorado Paycheck Calculator Smartasset

I Live In One State Work In Another Where Do I Pay Taxes Picnic S Blog

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll